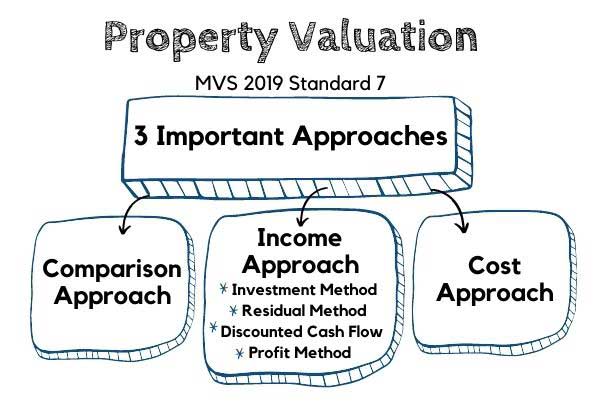

The 3 Important Property Valuation Approaches (methods) in Malaysia

The Malaysian Valuation Standard 2019 (MVS Standard 7) explained about property valuation approaches and methods. The approaches to valuation used by a Valuer in any valuation are the means by which the Valuer arrives at an opinion of value after having ascertained and weighed all relevant facts (physical, legal, economic and others) pertaining to the property and based on the Valuer’s judgement and experience.

Property Valuation Approaches

Registered real estate valuers or property valuers help report the opinion of Market Value of the property. Professional valuers in Malaysia generally have three main valuation approaches. The approaches used by them in any valuation are the means to derive an opinion of valuers after having ascertained and weighed all relevant information inclusive of its physical condition, legal aspects of the property, economics, functional uses related to it together with other appropriate consideration and it is based on valuers’ professional judgment and experience.

Comparison Approach

The most commonly property valuation approaches used is Comparison Approach, which compares directly or indirectly by using a specific format such as land and building value, where the valuer analyses and derives the market rate objectively. In other words, the approach compares assets or properties with available market evidence and prices. Ideally, valuers look for market-traded considerations of similar properties. Consideration is taken on the available information, volatility of the market, similarity & difference, adjustment required, reliability of the information, income-producing ability, timeliness, and so on.

Income Approach

The second property valuation approach is Income Approach, whereby the valuers look into the income generation capacity and the property potential in this area. Within this approach, it can be divided into four main methods, namely, Investment Method, Residual Method, Discounted Cash Flow Method, and Profit Method.

Investment Method

In Investment Method, consideration is taken on the gross rental, outgoings or cost and capitalization rates and reversionary interests.

This method normally is applicable to investment properties that are those with rent generating like offices, retail space and complexes.

Residual Method

As for the Residual Method, it normally applies to property development which landowners and developers would be more interested in. It basically apply the Gross Development Value less Gross Development Cost and takes into account of the development period with an appropriate discount rate before deriving the Market Value.

Discounted Cash Flow Method

Thirdly, the Discounted Cash Flow method, also known as the DCF method, normally is used to arrive at the Market Value of the property interest by applying the cash inflow and cash outflow. It can be applied to the development interest between Joint Venture Partners. It adopts appropriate assumptions and estimates with a market-driven discount rate.

Profits Method

Finally, the Profits Method where it estimates gross earnings from businesses such as hotels and petrol stations, taking into account of previous historical data and the future outlook of the business. Thereafter, operating cost is established with a reasonable basis, minus off the tenant or operator’s remunerative interest and finally deriving the market value by capitalizing the annual rent as a function of profit.

Cost Approach

After introducing both the Comparison Approach and Income Approach, the last property valuation approach is the Cost Approach. The Cost Approach involves taking into account the buildings, structures, and improvements and assessing their cost. At the same time, allowance for depreciation and obsolescence is made on the buildings before deriving the Market Value, which is the sum of the cost of the building and the land.

Conclusion

In all property valuation approaches mentioned above, valuers need to practice professional judgment and determine the most appropriate approach and method to use. The valuation conclusion should be reasonable and supported by a clear basis of evidence. If you would like to learn more about the important property valuer roles and the purpose of valuations, please click the button below.